Introduction to leverage ratio formula

leverage ratio formula Leverage is a fundamental concept in finance that determines how much debt a company or an individual is using to finance their operations. It is a crucial metric for investors, creditors, and financial analysts to assess risk levels. The leverage ratio formula provides a clear way to evaluate an entity’s financial health by measuring its debt levels compared to equity, assets, or earnings.

In this guide, we will break down the leverage ratio formula, explore different types of leverage ratios, and discuss their significance in financial analysis. Whether you’re a business owner, investor, or finance enthusiast, understanding leverage ratios will help you make more informed decisions.

What Is the Leverage Ratio Formula?

The leverage ratio formula is a financial metric that measures the proportion of a company’s debt relative to its equity, assets, or earnings. The basic leverage ratio formula is:

Leverage Ratio = Total Debt / Total Equity

However, there are several variations depending on what aspect of leverage is being analyzed. Some of the most common leverage ratios include:

- Debt-to-Equity Ratio (D/E)

- Debt-to-Assets Ratio

- Interest Coverage Ratio

- Debt-to-EBITDA Ratio

Each of these ratios provides different insights into a company’s financial stability and risk exposure. We will explore these in more detail in the following sections.

Types of Leverage Ratios and Their Formulas

Debt-to-Equity Ratio (D/E)

The Debt-to-Equity Ratio measures the proportion leverage ratio formula of a company’s debt compared to its shareholders’ equity. It is calculated as:

Debt-to-Equity Ratio = Total Debt / Total Equity

This ratio helps investors understand how much of a company’s financing comes from debt versus equity. A high D/E ratio indicates that a company relies more on borrowed money, which can be risky during economic downturns.

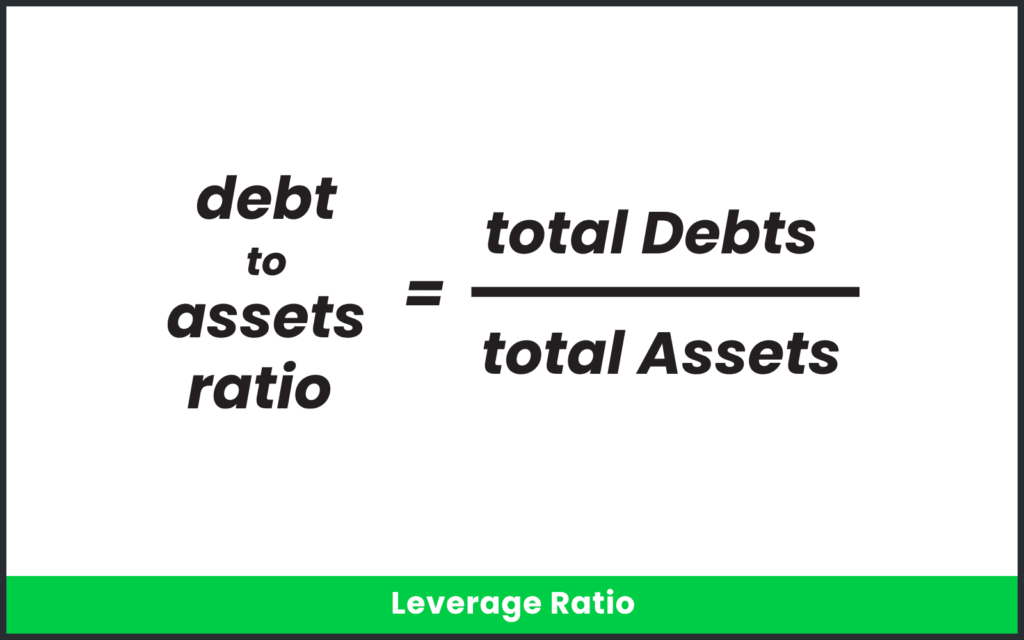

Debt-to-Assets Ratio

The Debt-to-Assets Ratio evaluates how much of a company’s assets are financed through debt. The formula is:

Debt-to-Assets Ratio = Total Debt / Total Assets

A higher ratio suggests a company has a significant portion leverage leverage ratio formula ratio formula of its assets financed through debt, which may signal higher financial risk.

Interest Coverage Ratio

The Interest Coverage Ratio measures a company’s ability to pay interest expenses on its outstanding debt. It is calculated as:

Interest Coverage Ratio = EBIT / Interest Expense

A higher interest coverage ratio indicates that a company generates leverage ratio formula sufficient earnings to cover its interest obligations, making it financially stable.

Debt-to-EBITDA Ratio

The Debt-to-EBITDA Ratio evaluates a company’s ability to pay off its debt using its earnings before interest, taxes, depreciation, and amortization (EBITDA). The formula is:

Debt-to-EBITDA Ratio = Total Debt / EBITDA

A lower ratio means a company has stronger financial health and can leverage ratio formula comfortably meet its debt obligations.

Why Leverage Ratios Matter

Leverage ratios are essential in financial analysis for several reasons:

Risk Assessment

Leverage ratios help investors and creditors assess the financial risk A lower ratio means a company has stronger financial health and can leverage ratio formula comfortably meet its debt obligations.

associated with a company. A high debt ratio suggests that a company may struggle to meet its obligations if revenue declines.

Investment Decision-Making

Investors use leverage ratios to determine if a company is a safe investment. Companies with lower leverage ratios are often considered more stable, while those with high leverage ratios may offer higher returns but carry more risk.

Loan and Credit Approval

Banks and financial institutions analyze leverage ratios before granting loans. A company with a high debt-to-equity ratio may find it difficult to secure additional financing due to perceived risk.

Business Growth and Expansion

Leverage can be a useful tool for business growth. Companies often use debt to finance expansion projects, acquire new assets, or invest in research and development. However, excessive leverage can lead to financial distress.

How to Interpret Leverage Ratios

Interpreting leverage ratios involves comparing them against industry benchmarks, historical data, and economic conditions. Here’s how you can analyze leverage ratios effectively:

Compare with Industry Standards

Different industries have varying acceptable leverage ratios. For instance, capital-intensive industries like utilities and manufacturing typically have higher debt ratios than tech startups.

Evaluate Over Time

Monitoring leverage ratios over multiple periods helps assess whether a company’s financial risk is increasing or decreasing.

Consider Economic Conditions

During economic downturns, companies with high leverage may struggle more than those with lower debt levels.

Assess Overall Financial Health

Leverage ratios should not be analyzed in isolation. They should be considered alongside other financial metrics such as liquidity ratios, profitability ratios, and cash flow statements.

Conclusion:

Leverage ratios provide critical insights into a company’s financial health, debt levels, and risk exposure. While leverage can be a powerful tool for growth, excessive debt can lead to financial instability. By understanding and interpreting leverage ratios correctly, investors, business owners, and financial analysts can make informed decisions.

Whether you’re managing a business, investing in stocks, or analyzing financial reports, keeping an eye on leverage ratios will help you navigate financial risks effectively. Always aim for a balanced approach—leveraging debt wisely while maintaining financial stability.