Introduction to nvidia stock split

NVIDIA Corporation has been a dominant force nvidia stock split in the technology sector, particularly in graphics processing units (GPUs), artificial intelligence (AI), and data center solutions. The company’s stock has seen tremendous growth over the years, making it one of the most valuable semiconductor firms in the world.

For long-term investors and traders, NVIDIA’s stock performance has been nothing short of spectacular. However, with rapid price appreciation, the cost of a single share can become expensive, making it less accessible to smaller investors. This is where a stock split comes into play.

A stock split can generate excitement and nvidia stock split impact investor sentiment. But what does it mean for NVIDIA? Let’s dive into the details of NVIDIA’s stock splits, how they work, and what they could mean for investors.

What Is a Stock Split and Why Does It Matter?

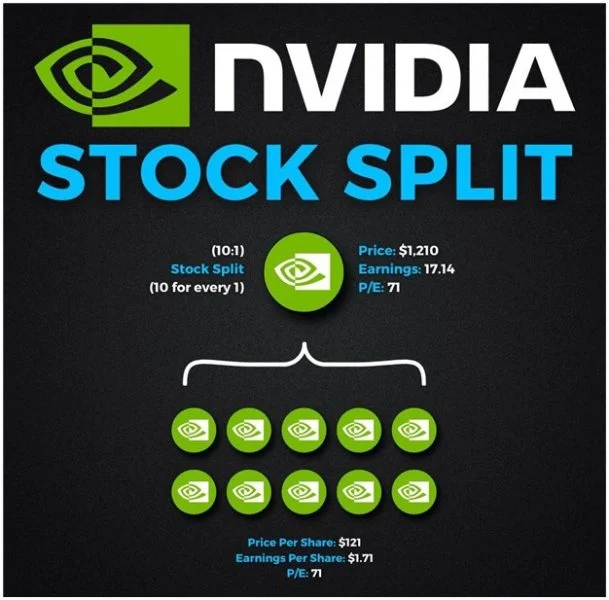

A stock split is a corporate action where a company increases the number of shares available while proportionally reducing the stock price. The fundamental value of the company remains unchanged, but the shares become more affordable for retail investors.

Stock splits typically come in ratios like 2-for-1, 3-for-1, or even higher, depending on the company’s decision. For example, in a 2-for-1 stock split, every existing share nvidia stock split is split into two, and the price per share is halved.

Why does this matter? Stock splits can make shares more accessible to a broader range of investors, increase liquidity, and sometimes boost market sentiment. While a stock split doesn’t change a company’s intrinsic value, it can influence how investors perceive the stock, potentially leading to increased demand.

NVIDIA’s Stock Split History

NVIDIA has undergone multiple stock splits nvidia stock split throughout its history. These stock splits have allowed the company to maintain accessibility for investors while continuing its upward trajectory in the market.

- June 27, 2000 – 2-for-1 stock split.

- September 17, 2001 – 2-for-1 stock split.

- April 7, 2006 – 2-for-1 stock split.

- September 11, 2007 – 3-for-2 stock split.

- July 20, 2021 – 4-for-1 stock split.

Each of these splits came at a time when NVIDIA’s stock had appreciated significantly, making it harder for smaller investors to buy shares. These splits have been effective in keeping the stock nvidia stock split attractive while allowing for continued growth.

The Impact of NVIDIA’s Last Stock Split in 2021

NVIDIA’s most recent stock split was a 4-for-1 split on July 20, 2021. Before the split, the stock was trading above $750 per share. After the split, the price adjusted to around $187.50 per share, making it more affordable for retail investors.

The impact of the 2021 split included:

Increased accessibility: The lower share price allowed more retail investors to nvidia stock split participate in NVIDIA’s stock, increasing trading volume. Improved liquidity More shares in circulation meant smoother trading and tighter bid-ask spreads.Positive market sentiment Investors often view stock splits as a bullish signal, leading to short-term price appreciation.

While stock splits don’t inherently increase a company’s valuation, the increased interest and trading activity can drive the stock price higher over time.

Will NVIDIA Announce Another Stock Split?

Given NVIDIA’s strong growth trajectory, many investors wonder whether another nvidia stock split stock split is on the horizon. The stock price has continued to rise since the last split, and if it climbs significantly higher, NVIDIA might consider another split to maintain accessibility.

Here are some factors that could influence a future stock split:

- Stock Price Level – If NVIDIA’s stock trades at a high price again (e.g., above $500-$600 per share), management might consider another split.

- Market Conditions – Bullish market sentiment and strong earnings performance could encourage a split.

- Investor Demand – If retail investors struggle to afford full shares, a split could help attract more participation.

While there’s no guarantee of another stock split, NVIDIA has a history of implementing splits when its stock price appreciates significantly. If the trend continues, another split could be likely in the near future.

Benefits of an NVIDIA Stock Split for Investors

If NVIDIA announces another stock split, it could present several nvidia stock split advantages for investors. Some of the key benefits include:

More Affordable Shares

A lower stock price per share allows retail investors to buy in at a more reasonable cost. This is especially beneficial for those who don’t use fractional shares.

Increased Liquidity

Stock splits typically increase trading volume, making it easier to buy and sell shares without impacting the stock price significantly.

Potential for Short-Term Gains

Historically, stock splits have led to short-term price increases as investors rush to buy shares after a split.

Psychological Advantage

Investors often perceive lower-priced stocks as more attractive, even if the nvidia stock split company’s overall valuation remains the same. This can drive demand and boost sentiment.

Potential Downsides of a Stock Split

While stock splits have many advantages, there are also some potential nvidia stock split drawbacks to consider:

No Fundamental Value Change

A stock split doesn’t increase NVIDIA’s market capitalization or fundamentally nvidia stock split improve the company’s financial health. It’s purely a structural change.

Increased Volatility

Lower-priced stocks can sometimes experience more volatility, as a broader range nvidia stock split of investors, including short-term traders, participate.

Investor Expectations

Once a company starts implementing stock splits, investors may expect them regularly. This can lead to disappointment if NVIDIA decides against another split.

Conclusion:

NVIDIA’s stock has been a powerhouse in the technology sector, and its past stock splits have helped maintain accessibility for investors. If NVIDIA announces another split in the future, it could provide an opportunity for new investors to enter the market at a lower price per share.

However, it’s essential to remember that stock splits don’t change a company’s intrinsic value. Investors should focus on NVIDIA’s long-term growth potential, financial performance, and market position when making investment decisions.

Ultimately, whether or not NVIDIA executes another stock split, the company’s strong presence in AI, gaming, and data centers makes it a compelling investment for those with a long-term perspective.